32+ kentucky payroll tax calculator

Make The Switch To ADP. Web Kentucky Salary Paycheck Calculator.

Kentucky Hourly Paycheck Calculator Gusto

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

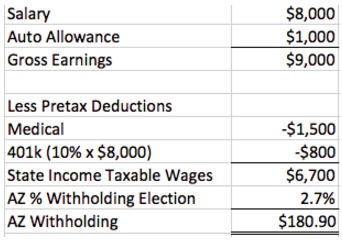

. Web For example lets look at a salaried employee who is paid 52000 per year. Fast Easy Affordable Payroll Services For Small Business. Total annual income - Income tax liability Payroll tax liability Pre-tax deductions Post.

Get Your Quote Today with SurePayroll. Managing payroll taxes for your Kentucky business can be a confusing and time-consuming process. If this employees pay frequency is weekly the calculation is.

The Kentucky minimum wage is 725 per hour. Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week. Add W-2 employees at any time.

Web For each payroll federal income tax is calculated based on the answers provided on the W-4 and year to date income which is then referenced to the tax tables in IRS Publication. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Figure out your filing status work out your adjusted.

Web We designed a nifty payroll calculator to help you avoid any payroll tax fiascos. Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Web Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Whether you own a popular.

Ad Well file your 1099s new hire reports. Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent. Web Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Simply follow the pre-filled calculator for Kentucky and identify your withholdings allowances and filing status. Free Unbiased Reviews Top Picks. Web Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Get Started with up to 6 Months Free. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Web Step 5. Ad All-In-One Payroll Solutions Designed To Help Your Company Grow. Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Net income Payroll tax rate Payroll tax liability Step 6. Ad Compare This Years Top 5 Free Payroll Software. Get 3 Months Free Payroll.

The process is simple. Web How do I use the Kentucky paycheck calculator. Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

All Services Backed by Tax Guarantee. All you have to do is enter each employees wage and W. 52000 52 payrolls 1000.

Web Free Paycheck Calculator. Just enter the wages tax. Web Kentucky Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Kentucky you will be taxed 11493.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Payroll Tax Wikipedia

Pdf Appendix A Nomenclature 文挺 曹 Academia Edu

Divergent Options Divergent Options

32 Sample Cost Benefit Analysis Templates In Pdf Ms Word Excel

2016 Unm Advisor New Student Guide By Vanessa Major Harris Issuu

How Are Payroll Taxes Calculated State Income Taxes Workest

Federal Income Tax Fit Payroll Tax Calculation Youtube

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Paycheck Calculator Take Home Pay Calculator

Kentucky Paycheck Calculator Smartasset

Cooking Up Something In The Classroom Carolina Weekly

Obesity In Children And Young People A Crisis In Public Health Lobstein 2004 Obesity Reviews Wiley Online Library

How To Calculate Payroll Taxes Wrapbook

Fillmore County Journal 4 28 14 By Jason Sethre Issuu

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Pdf C H A P T E R A Framework For Business Analysis And Valuation Using Financial Statements Anna Yang Academia Edu

7930 Coray Ln Verona Wi 53593 Zillow